CFO’s Guide

to Increase Profits

Turn Your Accounts Payable into a Profit Center

Watch Your Business Grow by Automating Supplier Payments

A major challenge for CFOs is to develop strategies for faster business growth while also managing finances and keeping costs in check. It can be pretty tricky.

Fortunately, there is an easily implementable solution that will help you meet that challenge: automated payments to suppliers.

It’s a smart move that savvy business leaders are discovering, because it will transform your accounts payable into a profit center.

Benefits of Automated Supplier Payments

Increase profit margins

Capture more early-payment discounts

Earn cash-back rebates on supplier payments made via card

Gain real-time visibility into outbound cash flows and corporate spending

Four Steps to More Profit

There are four steps that CFOs can take to transform their accounts payable department into a profit center.

1. Pay Suppliers Electronically

Electronic payments are a strong foundation for working capital optimization initiatives. Even better, automated electronic payment processes cost 60% less on average than their manual paper-based counterparts.

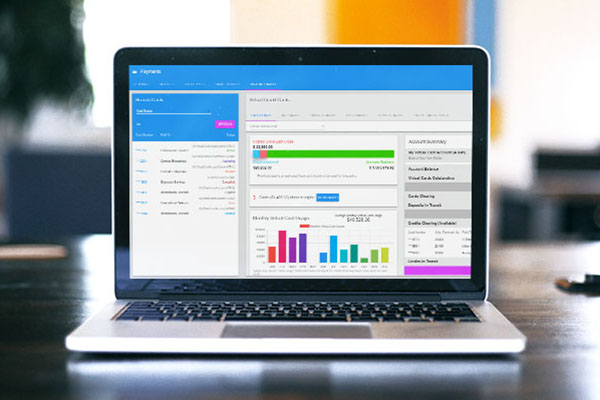

2. Enhance Visibility into Outbound Cashflow

Your accounts payable departments will become an information hub that provides critical insights into cash flows, corporate spending, and operations performance.

Spend- and supplier-specific data can be leveraged to identify spend trends and patterns, support future supplier negotiations, and can determine how well-positioned a company is to take advantage of supply chain financing options.

3. Accelerate Cycle Times

Accelerate invoice approval cycle times will create more opportunities to capture early payment discounts from suppliers. The savings from early payment discounts add up – and will more than offset accounts payable overhead.

4. Earn Cash-Back Rebates

Capture cash-back rebates on payments made via a virtual card – plastic-less cards tied to a single transaction. Businesses commonly earn cash-back rebates on 30 percent of their spending. In fact, one real estate company earned $800,000 in cashback rebates in one year on virtual card transactions.

Want to learn more about transforming accounts payable into a profit center?

Speak to an expert to find out how much you could be saving.