What Is B2B Payment Automation?

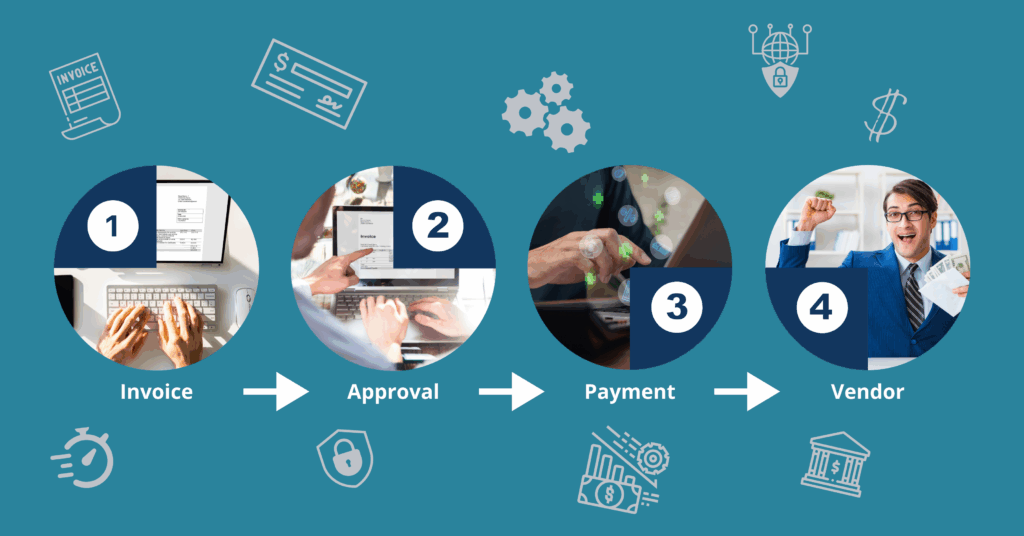

B2B payment automation refers to the use of technology to streamline how businesses pay their vendors, suppliers, and service providers. Instead of manually cutting checks, printing documents, and routing invoices by email or paper, companies automate these processes for speed, accuracy, and control.

The result? Less time chasing down approvals, fewer errors, faster payments — and real cost savings.

Why Businesses Are Automating B2B Payments

Manual accounts payable (AP) processes are slow, expensive, and risky. According to the Institute of Finance & Management (IOFM):

The average cost to process a single invoice is $15.97 manually, compared to $12.98 with automation.

Source: IOFM 2021 Benchmarking Report

And that doesn’t include:

Lost or duplicate invoices

Manual data entry errors

Delayed approvals

Missed early-payment discounts

Increased fraud exposure

Why Start With Payments, Not Invoices?

Many companies assume invoice automation should come first. But payment automation delivers faster ROI and immediate operational gains.

💡 Here’s why starting with payment automation is smarter:

Immediate savings on paper, postage, toner, and labor

Faster setup — payment solutions can be implemented in weeks, not months

Boosted productivity by freeing up AP staff from manual check runs

Improved fraud protection via Positive Pay and ACH integration

What EZPayManager/400 Brings to B2B Payment Automation

EZPayManager/400 by ACOM is a robust AP automation solution designed for IBM i (System i / AS400) environments. It supports both paper checks and electronic payments, with deep integration into ERP and accounting systems.

Key Features:

-

ACH and CPA Payments

Send secure electronic payments in the U.S. and Canada. -

Custom Check Design and Printing

Design and print MICR checks with full audit controls and user permissions. -

Positive Pay Integration

Reduce fraud by sending check issue files directly to your bank. -

Email Remittance

Automatically notify vendors of payments via email — no extra steps. -

PDF Conversion & Archiving

Save checks as searchable PDFs for fast retrieval and compliance. -

Manual Check Module

Issue ad hoc checks on demand with full visibility. -

Multi-printer Distribution

Split large print runs or route copies to different departments with cluster/distributed printing.

Built for Control, Security, and Compliance

With role-based access, checkbook-level permissions, and audit logging, EZPayManager helps AP departments manage risk, ensure accuracy, and stay audit-ready.

You can:

Control who prints, edits, or merges check data

Track every action down to the user level

Automatically generate Positive Pay files to your bank’s specification

- Create ACH files and send payment notifications automatically by email

From Cost Center to Profit Center

With EZPayManager, your AP department does more than just cut checks — it drives value:

Reduce per-invoice processing costs

Eliminate paper waste and printing overhead

Design custom check overlays with your company logo — no need to buy pre-printed stock

Capture early-payment discounts and maximize rebate revenue

Apply secure, stored signatures to every check — no manual signing required

Strengthen vendor relationships with fast, accurate payments

Ready to Automate B2B Payments?

EZPayManager gives you complete control over how you pay — securely, efficiently, and profitably.

Start with payments. Save time. Reduce cost. Drive profit.

Talk to an ACOM expert or call (800) 603-6768 ext. 2 or [email protected].